tax benefit rule definition and examples

Meaning pronunciation translations and examples. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Note however that the tax.

. This amount must be included in the employees wages or reimbursed by the employee. Benefits Received Rule. Section 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income.

Taxes are levied in almost every country of the world primarily to raise revenue for government. A reduction in the amount of tax that a person or organization would normally have to pay in a. A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayers burden while typically supporting certain types of commercial activity.

A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government. In the above example the taxpayers AGI was reduced by 24323. Multiply the face value bond price when issued by 025.

The benefit of something is the help that you get from it or the advantage that results. Personal use is any use of the vehicle other than use in your trade or business. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period.

For 2022 the standard. Tax Benefit means a reduction in the Tax liability of a taxpayer or of the affiliated group of which it is a member for any taxable period. Legal Definition of tax benefit rule.

Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule. If the amount of the loss. Tax benefit rule definition April 25.

The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the. Tax benefit definition. Tax benefit rule n.

Taxation imposition of compulsory levies on individuals or entities by governments. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. A tax provision that says.

The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the.

Take the result above and multiply it by the number of full years between the time you purchased the discounted bond. The tax benefit is the lessor of the actual deduction claimed or the amount the deduction causes your total itemized deductions to exceed your applicable Standard Deduction. Amount did not reduce the amount of tax imposed by Chapter 1 of the Code.

The recovery exclusion for the taxable year for which section 111 items were deducted or credited that is the original taxable year is the portion of the aggregate amount. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction.

Section 80c Deduction Under Section 80c In India Paisabazaar Com

Tax Advantages For Donor Advised Funds Nptrust

Income Tax It Returns Rules What Is Income Tax For Fy 2021 22

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Gross Rental Income Rental Income Buying A Rental Property Investing

Advantages And Disadvantages Of Trial Balance Trial Balance Accounting Basics Accounting Principles

Section 80ee Deduction For Interest On Home Loan Tax2win

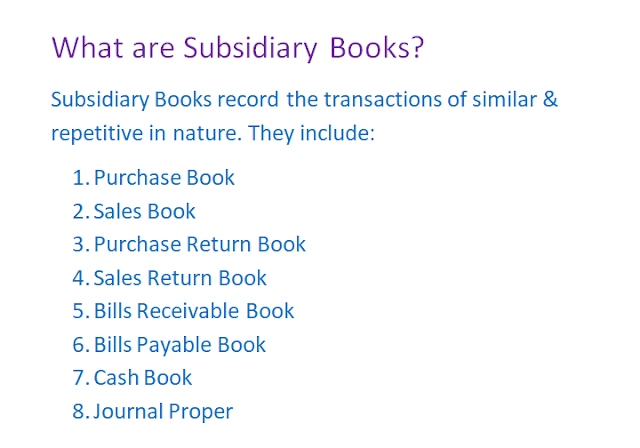

What Are Subsidiary Books And Its Types Profit And Loss Statement Cash Flow Statement Book Meaning

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

When To Use Comma Essay Writing Skills Learn English Grammar Comma Rules

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Tax Benefits Of Nps Scheme Deduction Coming Under Section 80ccd 1b Tax2win

What Is The Rule Of 72 A Simple Definition And Examples Rule Of 72 Simple Definition Investing

Value Investors Are Not Frequent Traders Valueinvestors Are Focused On The Long Term Whereas Traders Are Fo Investing Investing Strategy Investing In Stocks

Section 80ddb Diseases Covered Certificate Deductions Tax2win